Table of content

Challenges to incorporate AI into the insurance industry

Best practices to manage insurance AI projects

Our clients

Summary

Enhance AI Initiatives with High-Quality Labeling in Insurance Industry

The use of artificial intelligence (AI) in the insurance industry has gained considerable momentum in recent years, revolutionizing various aspects of insurance operations and customer experience. AI technologies, such as machine learning, natural language processing, and predictive analytics, are being employed to streamline processes, enhance risk assessment, automate claims processing, detect fraud, and personalize policies, among other applications. By leveraging AI, insurance companies can make data-driven decisions, improve operational efficiency, mitigate risks, and deliver more tailored products and services to policyholders also utilizing AI in these insurance processes can enhance precision and result in cost savings.

However, there are some obstacles that currently make it difficult to fully integrate AI into existing insurance systems.

Challenges to incorporate AI into the insurance industry

- Managing Data Quality and Availability: ML models and algorithms heavily rely on high-quality and diverse data. However, insurance companies may encounter challenges in ensuring the accuracy, completeness, and accessibility of data. Inconsistent or fragmented data sources can hinder models' effectiveness.

- Data Privacy and Security: Data privacy and security pose concerns in the insurance industry due to the sensitive customer information involved. Integrating AI requires robust measures to protect data and comply with regulatory requirements, such as HIPAA and GDPR, to maintain trust and confidentiality.

- Domain Expertise: Insurance-specific knowledge and expertise are required to label insurance-related documents and data correctly. It can be challenging to find labeling resources with deep understanding of insurance terminology, policies, and regulations.

- Scalability and Volume: Insurance companies handle large volumes of data and documents that need to be labelled. Scaling labeling operations to handle such volumes while maintaining accuracy and efficiency can be a significant challenge.

- Adapting to Evolving Insurance Requirements: Insurance practices, regulations, and products continuously evolve. Keeping the practices up to date and adaptable to changing insurance requirements can be a challenge. Continuous monitoring, feedback loops, and iterative improvements are essential to address evolving needs.

- Managing the cost: Building infrastructure and technology costs, data acquisition and management expenses, talent acquisition, training and model development costs (the time and costs of labeling data, and slow iteration cycles)

- Ethical and Bias Concerns: A growing challenge is the ethical considerations surrounding AI. The effectiveness of AI algorithms heavily relies on the quality of the data used for training, as biased data can result in biased outcomes that perpetuate discrimination and can impact the lives and financial security of people and their businesses.

Best practices to manage insurance AI projects

To overcome these challenges requires a combination of industry and domain expertise, quality control measures, and optimizing labeling processes to strike a balance between accuracy, cost-efficiency, and scalability of datasets

At Objectways we follow the Best Practices in labeling which include

- Adherence to precise guidelines: We establish well-defined guidelines that outline the criteria and instructions for labeling data. Clearly communicate the labeling process, including the types of labels required, the context in which labels should be applied, and any specific rules or conventions to follow.

- Executing KPT (Knowledge, Process, Test): Firstly, we establish a deep understanding of the insurance domain and its terminology to our team. Next, we define a standardized labeling process with clear guidelines for consistent and accurate labeling. Then there is regular testing and quality assurance to ensure the effectiveness of the process, allowing for continuous improvement and adaptation to changing insurance requirements.

- Strong Team Organization: Our team has implemented a well-organized structure consisting of labeling personnel, spot Quality Assurance (QA) reviewers, and dedicated QA professionals. This framework promotes responsibility, streamlined workflow, and unwavering quality.

- Performance Measures: We have established suitable quality indicators, including precision, recall, and F1 score, to evaluate the accuracy of labeling. We consistently monitor and analyze these measures to identify areas for enhancement and uphold exceptional quality standards.

- Continuous Feedback Loop: We have implemented a system for providing consistent feedback to labeling teams regarding their performance. This facilitates the resolution of any discrepancies, clarifies guidelines, and enhances the overall accuracy of labeling.

- Quality Control and Spot QA: By implementing robust quality control measures, including periodic spot QA reviews by experienced reviewers, helps identify and rectify any labeling errors, ensures adherence to guidelines, and maintains high labeling quality.

- Data Security and Privacy: Data security and privacy are of paramount importance in the insurance industry, necessitating stringent measures to safeguard sensitive information and protect customer confidentiality. Therefore, to validate our commitment to security and privacy controls, we have obtained the following formal certifications SOC2 Type2, ISO 27001, HIPAA, and GDPR. These certifications affirm our dedication to safeguarding customer data and they continue to expand, adhering to Privacy by Design principles and incorporating industry standards and customer requirements from various sectors.

Below are some of the representative use cases for our clients:

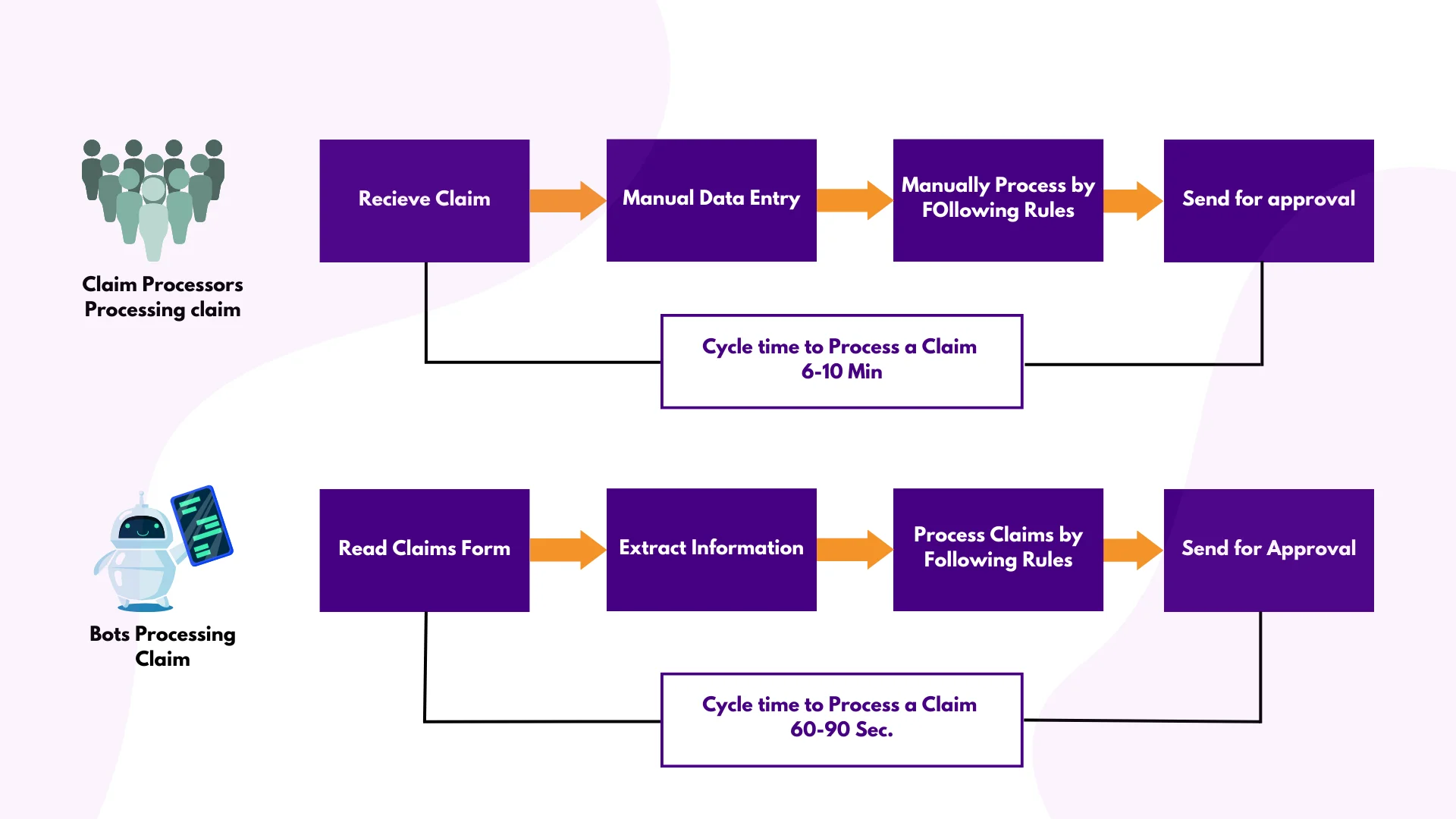

- Expediting and streamlining claims processing: Developing

AI-powered claims processing and adjustment systems for insurance companies face challenges

such as establishing human in the loop system, dealing with the time and cost-intensive

process of labeling data, and facing slow iteration cycles. At Objectways we offer

comprehensive support for all aspects of claims adjustment AI projects, offering solutions

that enhance model performance and accelerate time to market, thereby helping insurers

overcome these obstacles.

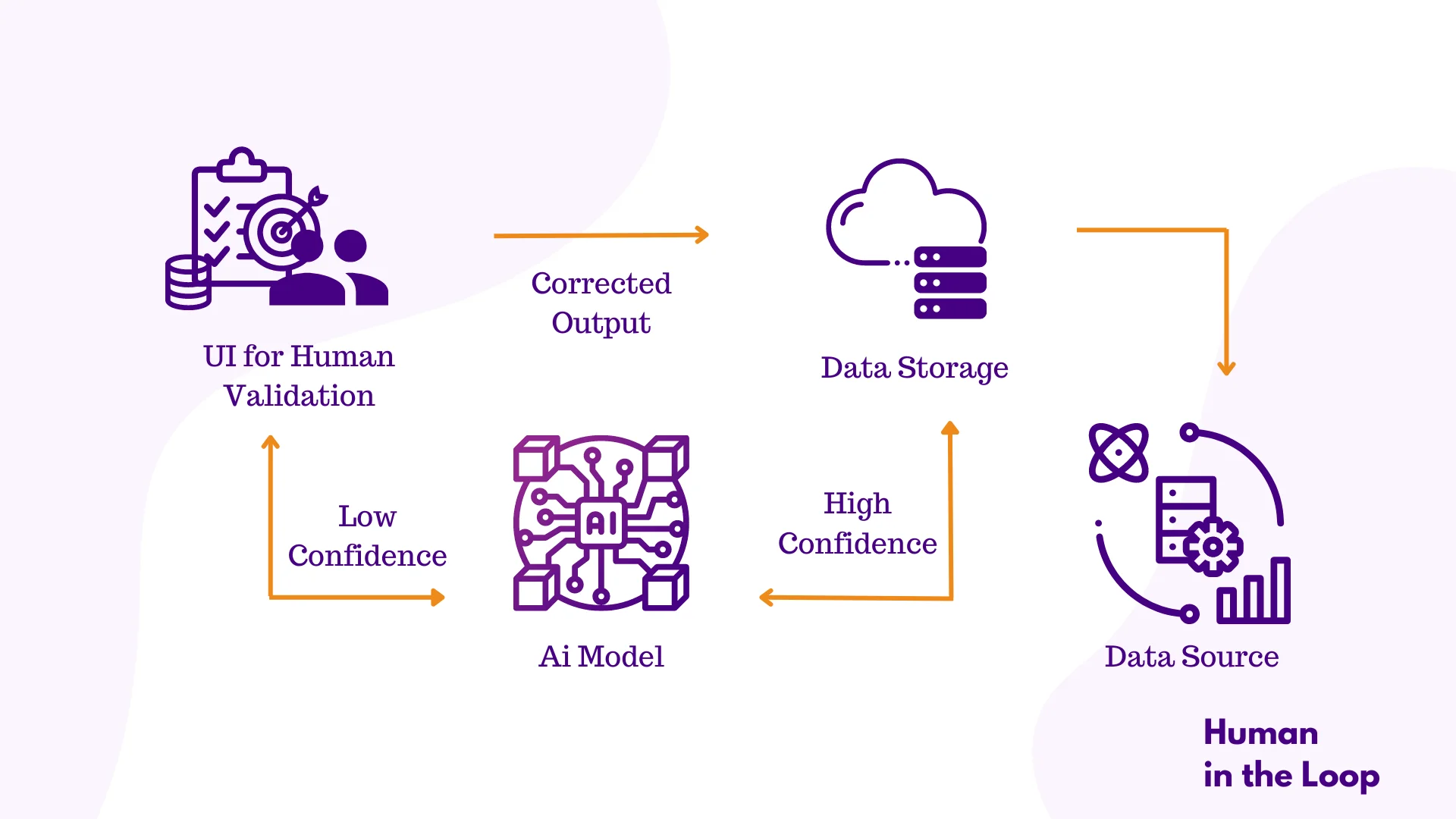

- Accelerating insurance documents faster with AI and human in the

loop:Expediting the processing of insurance documents by utilizing AI in

combination with human expertise. AI technologies like OCR and NER enable efficient

information retrieval, document understanding, and automated decision-making. Objectways

human-in-the-loop workflows ensures accuracy, quality control, in the above cases, enabling

faster processing while maintaining precision and compliance.

- Fast and Precise Underwriting: By training computer

vision models on geospatial data, underwriters can assess risks and property values without

the need for human inspection. At Objectways we offer comprehensive support for geospatial

data within all its products, enabling teams to visualize raw data, annotate information,

and curate location data for spatial analysis. This native support empowers teams to

leverage geospatial data effectively and make informed decisions based on accurate insights.

- Driving language and text AI development:At Objectways we

offer cutting-edge text labeling services to insurers, enabling them to harness the power of

large language models for enhancing recommendations, chatbots (Providing automated customer

service, answering frequently asked questions with personalization and empathy. Enabling

multi-lingual customer service by translating customers queries and responding in the

customers preferred language), risk assessments, and other applications. With our services,

insurers can accelerate and optimize the development of NLP-based AI, propelling

advancements in language and text processing.

Summary

At Objectways, our team consists of over 1000 experts specializing in Computer Vision, Natural Language Processing (NLP), and prompt engineering. They bring extensive experience in tasks like object detection, such as image segmentation and classification, as well as common language tasks like named entity recognition (NER), optical character recognition (OCR), and LLM prompt engineering.

In summary while there are challenges to fully integrating AI into the insurance industry, Objectways follows best practices in labeling to overcome these obstacles and ensure accuracy, cost-efficiency, and scalability of datasets. To learn more about how Objectways can revolutionize your insurance processes with AI, contact sales@objectways.com to provide feedback or have any questions.