Over the years, finance functions across companies have changed quite a lot thanks to new technologies. One of the latest and most promising developments is Artificial Intelligence (AI), or more specifically, generative AI. This type of AI can be used to create new content from scratch, whether that’s text, video, images, or audio.

Generative AI tools, such as ChatGPT, Google Bard, and Gemini, are being widely adopted by financial firms for various finance and accounting tasks. Some of these tasks include automating reporting, reconciling accounts, drafting audit notes, and even forecasting risks.

Such financial tasks can require lots of attention to detail, and small mistakes can often lead to regulatory fines or reputational loss. Generative AI tools can help reduce these mistakes, speed up reporting, flag anomalies, and produce compliance-ready documents with clear audit trails.

In particular, as financial regulations become increasingly complex, generative AI can enable more accurate and scalable accounting work. For CFOs (Chief Financial Officers) and compliance teams, that makes generative AI an impactful tool to rely on.

To get the most out of generative AI in accounting, though, CFOs need to understand not only what these tools can do today, but also how they’re likely to reshape the way finance teams work in the future.

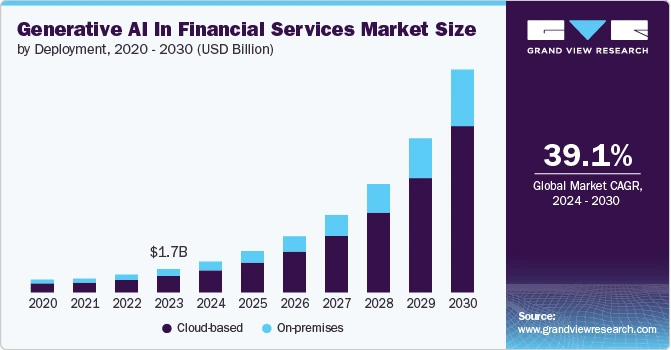

In this article, we’ll explore how generative AI in finance and accounting is making a difference. With the global generative AI in financial services market size projected to reach $16,018.1 million by 2030, we’ll also take a look at some case studies from different finance companies on how they use generative AI for accounting. Let’s get started!

The Global Generative AI in Finance Market. (Source)

Usually, finance and accounting are associated with number crunching. However, generative AI in accounting can perform more than just crunching numbers; it can create outputs like reports, summaries, or explanations from financial data.

Many banks and fintechs use it to turn long documents, spreadsheets, or even emails into clear insights. In simple terms, it helps make complex financial information easier to understand, like turning a messy puzzle into a complete picture.

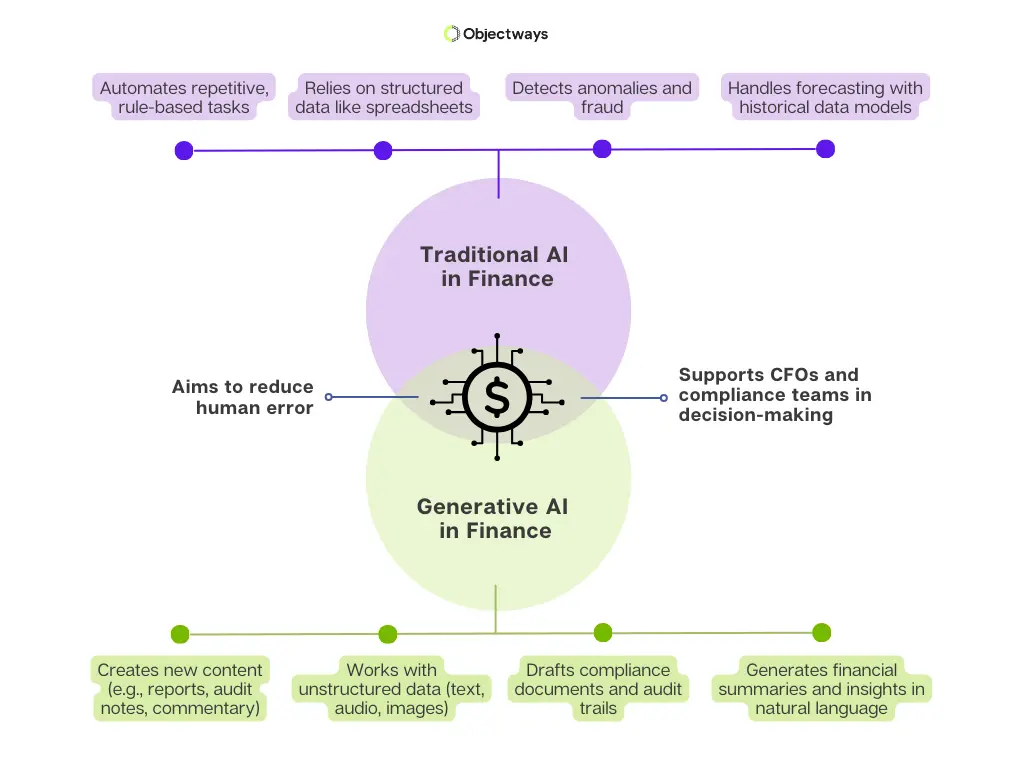

So, how is generative AI in accounting different from traditional AI in accounting? Traditional AI and automation are essentially machines that follow strict rules, which is ideal for routine tasks such as matching transactions or identifying duplicates.

But, they’re not reliable for tasks that involve a little bit of creativity. Generative AI does exactly that, “bring creativity”: it can write, summarize, and make sense of unstructured information. Instead of simply doing a task, it interprets and creates something new, making it far more flexible and human-like in how it works.

Traditional AI Vs. Generative AI in Finance and Accounting.

At the moment, generative AI mainly assists the financial sector by speeding up routine tasks and improving services. However, it still requires extensive human oversight. For example, it can’t identify a new market trend, build a full strategy around it, and carry it out automatically, or create and manage a customer’s investment plan on its own.

But in the future, it’s likely that generative AI will take on more advanced roles, supporting deeper decision-making and helping finance teams operate at an even higher level.

Here are some key ways generative AI can be used in accounting and finance:

Although generative AI brings many opportunities to finance and accounting, there are also some risks and challenges to consider. Next, let’s take a look at some of these limitations.

One main challenge is accuracy and bias. If a generative AI system is trained on poor or skewed data, it can produce misleading results. In finance, even small errors can lead to compliance issues or financial misstatements.

There’s also the “black box” problem. AI models often work in ways that are hard to explain, making it difficult for auditors, regulators, and leaders to fully trust their outputs, making it a ‘black box’. While AI improves speed and efficiency, accountants and auditors still need to stay actively involved to validate results and exercise judgment.

On top of this, sensitive financial data is required to train and run these generative AI systems, so without reliable safeguards, companies risk exposing client information or violating privacy laws. Legal and ethical issues also add a layer of complexity. To manage these risks, finance firms also need strong governance, transparency, and ethical standards.

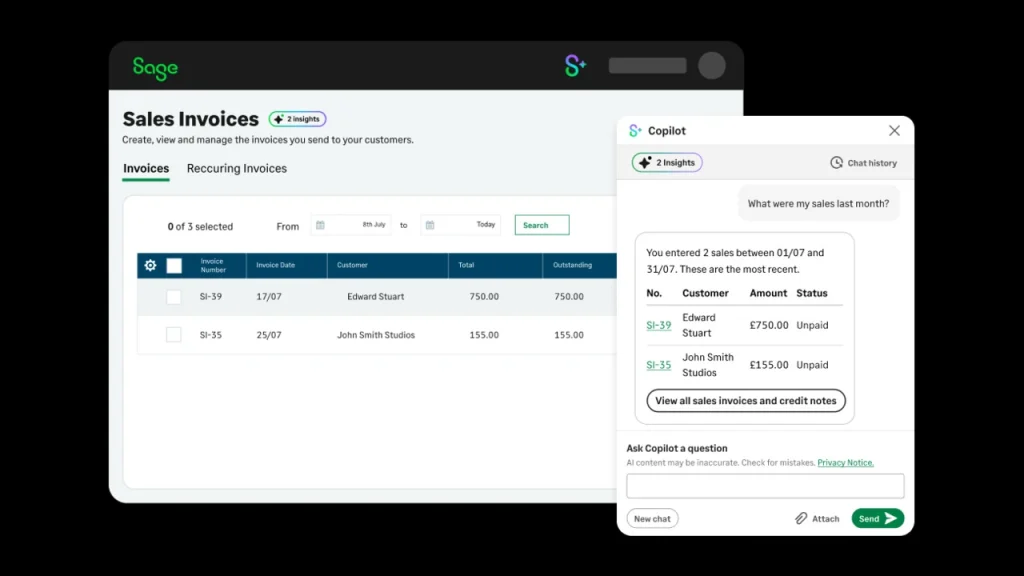

Sage Copilot is a recent example of how the limitations of generative AI can negatively affect a firm. In early 2025, Sage Group launched Sage Copilot, an AI assistant designed to answer financial questions. However, the tool mistakenly shared customer invoices with other users. While no sensitive data was exposed, Sage quickly suspended the tool and fixed the issue.

Sage Copilot (Source)

Despite the limitations of generative AI, many financial firms are successfully implementing it into their workflows. Now that we have a clearer picture of its potential in finance and accounting, let’s explore some real-world case studies.

Before using generative AI accounting tools, JPMorgan’s research teams struggled with the large amount of financial reports, regulations, and market data that they had to go through. Analysts spent hours summarizing and drafting documents manually, which slowed down insights and client service.

To tackle these challenges, JPMorgan rolled out its own version of ChatGPT, designed specifically for the company. The generative AI accounting tool was given to employees in its asset and wealth management division.

They use it for tasks like writing, generating ideas, and summarizing documents. It essentially acts like a digital research assistant. Approximately 50,000 company employees now have access to it. They’re actively using it to improve productivity within the firm.

JPMorgan’s Generative AI Tool in Asset Management. (Source)

In the Netherlands, multinational bank ING received about 85,000 customer queries each week through phone and chat. However, its outdated systems could only solve around 40 to 45% of the queries, leaving over 16,000 cases for human agents. This led to long wait times, limited support after hours, and a frustrating customer experience.

In order to solve these issues, ING teamed up with McKinsey to build a new generative AI chatbot. The chatbot pulls answers from trusted sources, ranks the best ones, and asks follow-up questions if needed. To keep it safe, the risk and compliance teams also added strict rules to prevent it from handling sensitive topics like mortgages or investments.

The generative AI chatbot solved about 20% more customer queries, delivering quicker and more accurate answers while reducing wait times. At first, it was rolled out to only 10% of mobile app users in the Netherlands and is now planned to expand across 40 countries, potentially serving 37 million ING customers.

Before generative AI, tasks like underwriting were slow and had to be done manually. Underwriting is the process of financial experts reviewing a loan, insurance policy, or investment to decide if the risk is worth taking and on what terms.

Each submission required detailed reviews, data collection, and drafting emails or documents by hand, which caused delays and added extra workload. This manual process also left room for errors and inconsistent decisions.

To solve such problems, Hiscox, an insurance provider, created a generative AI-based underwriting model for its line of sabotage and terrorism insurance risks. The model was created in collaboration with Google Cloud, and it uses Gemini (along with the company’s internal AI tools) to automate parts of the quote process. These include parsing submissions, assessing risk, generating email responses to brokers with pricing, and data prefilled for underwriter review.

As a result of using generative AI, Hiscox’s underwriting tasks were completed much faster than before. The generative AI model removed risk data, matching it with pricing and drafting messages for brokers.

Although the generative AI model now handles much of the prep work, human underwriters still make the final calls. This collaboration led to faster quotes, less manual effort, and more accurate, consistent responses.

To use generative AI effectively in finance and accounting, companies can start using it for safer and lower-risk tasks first. Human oversight and data being tightly protected with proper controls and records are key.

In general, generative AI solutions should be transparent, tested often for mistakes or bias, and follow key data protection laws like GDPR or SOX. GDPR is a European law that protects personal data, while SOX is a U.S. law that ensures accuracy and accountability in financial reporting.

Here are some other best practices for generative AI adoption in finance and accounting:

Following these best practices can be tricky, and working with an expert can make the process much smoother. Objectways helps finance teams put this into practice by offering responsible generative AI consulting services. This includes data annotation, combined with human oversight, strong data protection, and continuous monitoring.

From routine tasks to strategic insights, generative AI is opening up new possibilities in finance and accounting. Beyond automating everyday work, it is starting to support fraud detection, credit scoring, invoice handling, and even portfolio management.

For instance, generative AI–powered robo-advisors are also making investing more accessible by offering 24/7 monitoring and automatic portfolio adjustments. At the same time, AI-driven insights are helping finance teams anticipate risks and improve cash-flow forecasting.

The potential of these technologies is huge; banks expect AI to boost profits by more than $170 billion in the next five years. However, regulators caution that over-reliance on black-box models or a handful of vendors could create risks. The real challenge in the future is finding the right balance between efficiency, transparency, and trust.

Importantly, this shift isn’t limited to developed markets. In Nigeria, the fintech sector grew 70% in 2024; Indonesia saw digital transactions surge by 226% that same year; and in Egypt, fintech has expanded more than fivefold over the past five years.

This shift isn’t limited to developed markets; developing countries are also seeing a fintech boom because of AI adoption. In Nigeria, the fintech industry grew 70% in 2024. Similarly, Indonesia saw digital transactions jump by 226% the same year. And in Egypt, the fintech sector has grown more than fivefold over the past five years.

Generative AI in accounting is already changing the industry, from automating reports and compliance checks to speeding up research and improving customer service. However, there are several challenges to consider; issues such as data privacy, accuracy, and regulatory compliance require careful attention. By combining finance-specific generative AI tools with human oversight and strong data controls, firms can get the best of generative AI while keeping trust intact.

Ready to bring generative AI into your finance team? Book a call with Objectways today and see how we can help you implement AI responsibly with the right mix of technology, human oversight, and data protection.